Get the best deals for turbotax 2019 home business at eBay.com. We have a great online selection at the lowest prices with Fast & Free shipping on many items! Turbotax premier 2019 turbotax home business 2019 download turbotax home business 2019 mac turbotax home business 2019 cd turbotax deluxe 2019 intuit turbotax home business 2019. TurboTax 2019 - Manage your U.S. Taxes and maximize your return. Download the latest versions of the best Mac apps at safe and trusted MacUpdate. Platform:MAC Download Edition:Deluxe TurboTax Deluxe is recommended if you own your own home, donated to charity, have significant education or medical expenses, have child-related expenses or have a lot of deductions TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve, so you're confident. TurboTax Home & Business. Recommended for: Personal & Self-Employed. 1 state download 5 federal e-files included. Maximize next year's refund. Understand your tax history and know your “tax health“ with expert tips to help you get an even bigger refund next year. Turbotax 2019; Mac and Windows Download TurboTax Home & Business + State 2019 Download Turbotax Business is available for Windows operating systems only. (28 days ago) Intuit Market Coupon Code 2019 - 07/2020. Find low everyday prices and buy online for delivery or in-store pick-up.

- Download Turbotax For Mac 2019

- Turbotax Mac Download 2019 Download

- Turbotax Mac Download 2019 Windows 10

- Turbotax Deluxe For Mac

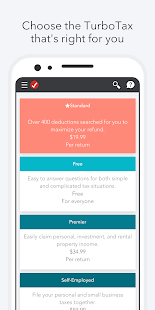

TurboTax Home & Business

Recommended for:

Personal & Self-Employed

Maximize next year's refund

Understand your tax history and know your “tax health“ with expert tips to help you get an even bigger refund next year.

- Employee tax forms

Prepare and print unlimited W-2 and 1099 tax forms for your employees and contractors.

- Extra guidance for new businesses

We'll show you the startup tax deductions for new businesses so you can get the maximum refund you deserve.

- Automatically import your investment info

We can automatically import investment info directly from participating financial institutions.*

- Guidance and support reporting investment sales

We'll walk you through reporting sales of stocks, bonds, and mutual funds. We'll automatically calculate capital gains/losses and keep track of those that carry over to future tax returns.

- Find your cost basis

In three easy steps you'll discover your accurate purchase price for stock sales.

- Employee Stock Plans

If you sold employee stock we'll automatically determine your correct basis for shares purchased.

- Maximize your IRA savings

Retirement tax help and IRA tool show you how to get more money back this year and when you retire.

- See your best rental depreciation method

Simplify reporting your rental property depreciation. We'll show you which depreciation method will get you the biggest tax deduction.

- Refinancing Deductions

Save every penny—we'll guide you through deducting points, appraisal fees, and more from your refinance.

- Guidance and support with new rental properties

We'll guide you on how to set up new rental properties. Plus, our median monthly rent calculator can help you find the fair market value for your rental property.

- Find every tax deduction and credit you qualify for

We'll get to know you by asking simple questions about your income, family and changes in your tax situation. Then, based on your answers, TurboTax will search for more than 350 tax deductions and credits to get you the biggest tax refund— guaranteed.

- Maximize your tax deduction for your donations

Accurately value items you donate to charity with ItsDeductible™ (included)—no more guessing. Plus, we'll track other donations such as cash, mileage and stocks, to help you get every tax deduction you're entitled to for your charitable donations.

- Big life changes? We can help

Did you change jobs, get married, buy a home or retire? We'll guide you through common life changes, explain how they impact your taxes, and find any new tax deductions and credits you may qualify for.

- See your audit risk

Reduce your chance of a tax audit with our Audit Risk Meter™. We'll check your tax return for common audit triggers, shows whether your risk is high or low and give you valuable tips.

- See if you qualify for education tax credits

If you or your children attended college or trade school, we'll help you find refund-boosting education tax credits and deductions (1098-E, 1098-T) for tuition, books, and student loan interest.

- Extra guidance for homeowners

Your biggest purchase can also mean big deductions for things like: mortgage interest, property taxes, refinancing fees, points, and improvements to your home'senergy efficiency.

- Automatic import of your W-2 and 1099 info

We can automatically import your W-2 and 1099 tax form data from over a million participating employers and financial institutions.*

- Get a head start

We'll automatically import your information from last year's TurboTax return to help save time and increase accuracy. We'll even import personal information about you and your family if you prepared your taxes with TaxAct or H&R Block CD/Download software.

- No tax knowledge needed

We'll ask you easy questions about your year and fill in the right tax forms for you.

- Answers as you go

Free U.S based product support and easy-to-understand answers online 24/7.

- Thousands of error checks

You won't miss a thing, we'll double-check your tax return for accuracy before you file.

- Get tax deductions for your dependents

We'll show you who qualifies as your dependent, and find tax-saving deductions and credits like the Child & Dependent Care Credit, Earned Income Credit (EIC), andchild tax credit.

- Finish your state return faster

Once you complete your federal taxes, we can transfer your information over to your state return to help you finish quickly and easily. (Fees may apply*)

- Go at your own pace—no appointment necessary

Finish your tax return in one visit or do a little at a time. We automatically save your progress as you go, so you can always pick up where you left off.

- Up-to-date with the latest tax laws

When tax laws change, TurboTax changes with them, so you can be sure your tax return includes the latest IRS and state tax forms.

- Your information is secure

We're dedicated to safeguarding your personal information. We test our site daily for security, use the most advanced technology available, and employ a dedicated Privacy Team.

- See your tax refund in real time

We display and update your federal and state tax refunds (or taxes due) as you do your income taxes, so you always know where you stand.

- Free federal e-file for your fastest possible tax refund*

E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. Free federal e-file is included.

- Your tax refund, your way

Choose to receive your tax refund by check or direct deposit to your bank account.

- No money out of pocket

Skip the trip to your wallet. We can conveniently deduct any TurboTax preparation fees from your federal tax refund and have the remaining balance deposited directly into your bank account. Additional fees may apply.

- Perfect for independent contractors (1099)

If you're an independent contractor or do freelance work you might get to deduct expenses like travel and entertainment to lighten that tax bill. That's where we come in, searching over 350 deductions and credits so you don't miss a thing.

Commonly Filed Tax Forms and Schedules

Minimum requirements for your MAC

Operating Systems

· macOS Sierra 10.12 or later.

RAM

· 2 GB or more recommended.

Hard Disk Space

· 650 MB for TurboTax.

Internet Connection

· 56 Kbps modem (Broadband connection highly recommended).

· Required for product updates.

Printer

· Any Macintosh-compatible inkjet or laser printer.

Technical Support

· www.turbotax.com/support

Get your maximum tax refund — guaranteed

-------------------------------------------------------------

Learn More:

http://turbotax.intuit.com/personal-taxes/cd-download/home-and-business.jsp

digital download- no cd will be shipped

Learn More:

http://turbotax.intuit.com/personal-taxes/cd-download/home-and-business.jsp

digital download- no cd will be shipped

TurboTax Home & Business

Recommended for:

Personal & Self-Employed

Maximize next year's refund